Tax Stamp Management

System

An end-to-end customized solution for governments to optimize tax revenue collection in excise products.

Our system is used by government agencies for revenue collection from tax stamps in excise products like tobacco, alcohol, cement, fertilizer, or in products which need to be authenticated (e.g. genuine pharma product program).

Fight Against Illicit Trade & Counterfeits

$40.5 Billion

Government revenue loss from the illicit trade of tobacco

products1

Health & safety risks

25%

Percentage of all alcohol consumed globally that is unrecorded according to WHO2

Financing of organized crime

40-50%

Percentage of illicit trade in the tobacco market in some

countries1

Tax evasion

Fight illicit trade

Increase excise

Tax evasion

Why use TrackMatriX?

Since 2012, the TrackMatriX SaaS platform has been used for digital authentication and consumer engagement using mobile phones. With the ability to generate 500 million UIDs (unique identification codes) in 30 minutes, TrackMatriX is scalable enough to be leveraged to gain deep supply chain and consumer insights and provide value-added, real-time engagement.

Through its partner, NanoMatriX Technologies, TrackMatriX as a platform has been used in tax stamp management by several countries. Since 2004, NanoMatriX’s operation follows the security printing standard ISO 14298:2013 and applies the ISO 22382:2018 to design, print and deliver tax stamps.

Over 25 billion

Authenticated tax &

excise stamps

ISO 9001:2015

certified since

2010

GS1

compliant

WHO FCTC

compliant

Tax Management System Features

& Benefits

Flexibility & Scalability : Government authorities can create secure tax stamps numbers and send the number file to the printer to print the labels.

Using our system, government agencies are free to choose the supplier of physical printed tax stamps. Most tax stamp printers supply a tax stamp management system but require the purchase of tax stamps (e.g. for tobacco) from that particular printer. However, if the government agency also issues tax stamps for other products (e.g. beverages), they need to make a decision whether they buy the beverage tax stamps from the same printer or from another printer. In case they buy from another printer, they may have to install and use another tax stamp management system to monitor application and inspection results.

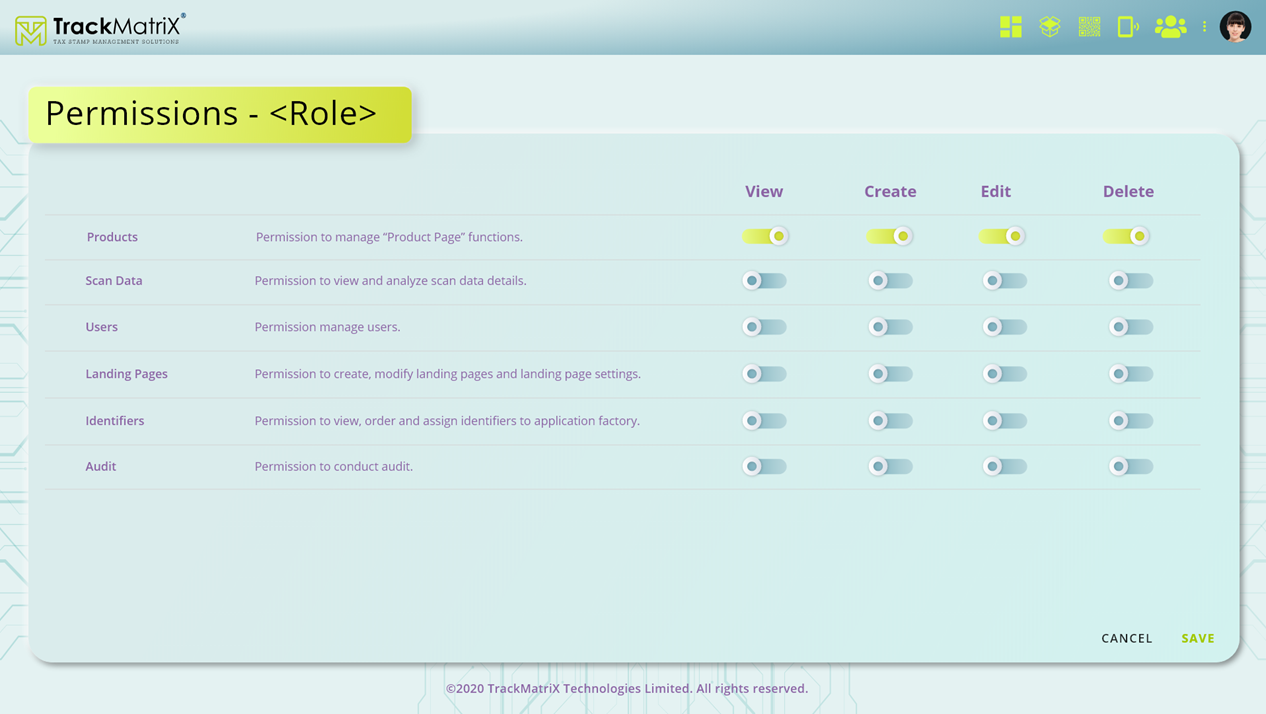

Sophisticated Permission Management

Highly detailed permissions can be given to users to execute specific tasks. Each user activity is monitored and can be reported.

There are many stakeholders in a national tax stamp program; hence, our system is built to make it easy to enroll and de-list stakeholders when necessary.

Different Government offices can monitor tax stamp application and inspection process per administrational region (state / provinces).

Value-add: Gadgets and Inspector Apps

Additional gadgets can feed data into the tax management system which can be reported. For example, camera systems that activate codes when the tax stamp is applied. New inspectors can also download an inspector app in which all inspections will be reported.

When online, the inspector app can receive data up to the assigned permissions.

● Label history, batch, delivery status, delivered to which manufacturer

● If applied, when applied, to what product, other details regarding the application

● product details, tax status, etc

Scanning activity is also saved so that admins can audit:

● Who was scanning

● What was scanned

● Where it was scanned

● When it was scanned

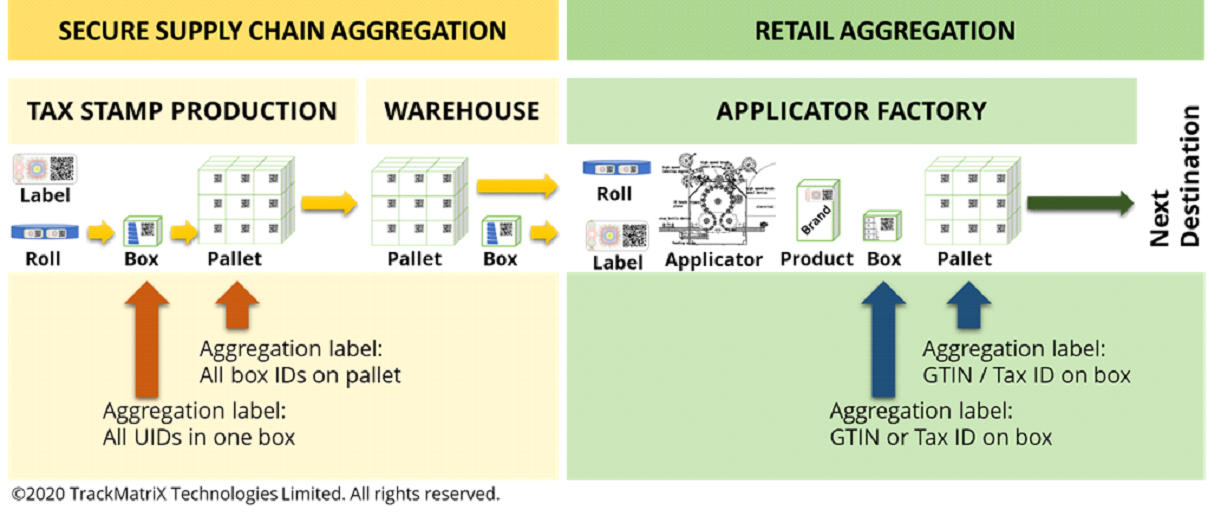

Use-case Example: Aggregation Systems Linking Parent-Child Relationships

To facilitate tracking units throughout the production process and supply chain, units can be aggregated with parent-child relationships maintained in a database. Aggregation is commonly understood as capturing and maintaining parent-child relationships between different packaging levels of a product. We are able to provide aggregation in two different areas:

- When the tax stamps are printed and delivered to the distribution center

- When the tax stamps are applied onto the product (child number), then the product is placed into a larger box (outside the box there will be a label applied, parent number) – our system will know which child number is in which box. Additional aggregation levels can also be added.

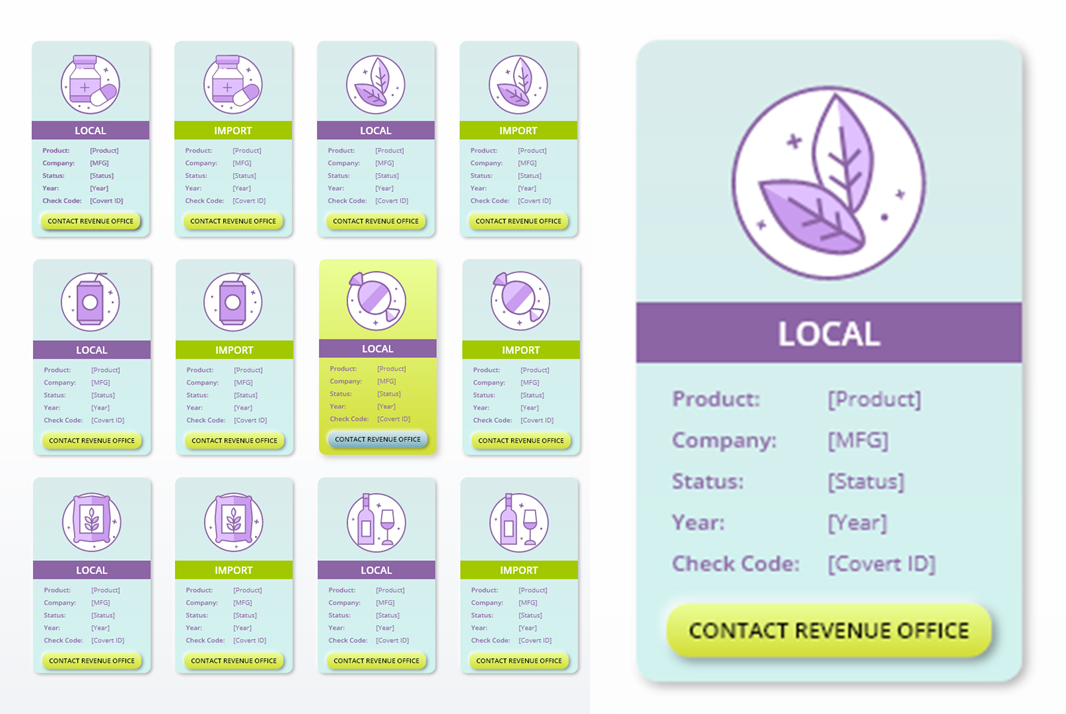

Managing Landing Pages

The TrackMatriX Tax Stamp Management System has a built-in landing page creator. That enables the user to create a new landing page, modify the existing landing page or implement policies to display to the user different landing pages, based on trigger events. All this can be done without IT knowledge. This function allows user to compose new landing pages which shall be used per taxable good or even per applicator factory and their brands.

We can provide custom landing pages for each taxable item displaying to citizens data which will be retrieved from the database. We can even give the application factory permission to access the landing page creator and they can modify the landing page of each product they authenticate in their own factory as they like, or as they are permitted by the tax stamp issuing authority.

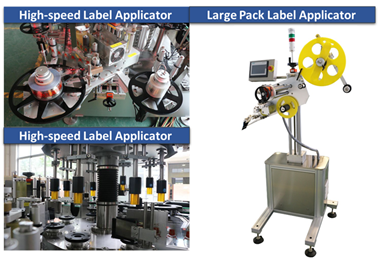

Label Applicator & Additional Services

As per requirement of many tax stamp programs equipment is required to apply the tax stamps labels or tax security mark, as well as peripheral inspection systems control mechanisms to mitigate the risk of fraudulent activities at the application factories at the highest possible degree. Hereto TrackMatriX can provide consulting services and equipment such as:

- Label applicators up to a speed of 20,000 labels per hour

- Connected visual inspection systems to capture applied tax stamp labels and active the tax stamps

- User Identity and Access Management system for operators of tax stamp applicator equipment.

Additional services can be provided upon request.

Use Cases

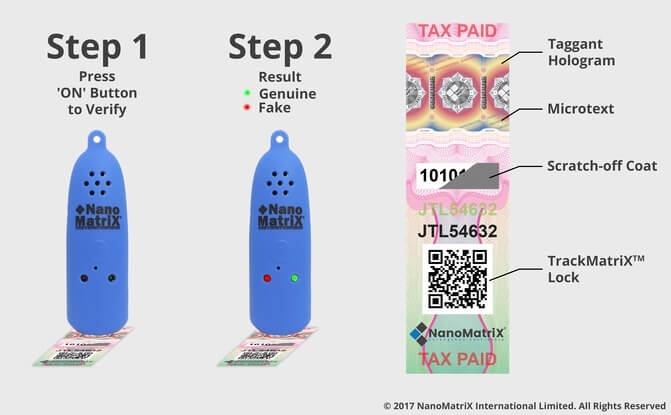

Upgrade Security Level of Tax Stamps

Problem

Our customer (government agency) wanted to upgrade the security level of their tax stamp features in several aspects. Thus, the new security features should be ultra covert and yet be easy to verify by mobile inspectors.

Our customer required a combination of sophisticated overt, covert, forensic security features which had to meet the requirements of various user-groups as well as harsh climate and lifecycle requirements. The tax stamps had to be absolutely copy proof, offer multiple inspection options by in-field inspectors, as well as local and international forensic document experts.

Solution

NanoMatriX proposed to use a high-tech covert-forensic MatriX-Mark™ Taggant as one of the most important security features in the printed tax stamps. The taggant used in every tax stamp project can be infused with a unique, project-specific, forensic signature to support court proceedings against counterfeiters with legal enforceable evidence – beyond any reasonable doubt.

NanoMatriX also provided several hundred HSDs (High Security Detectors) for easy and accurate in-field verification of the detectors. To ensure long life of the HSDs and the maximum convenience of use, all HSDs were supplied with USB charger, protective sleeve, branded lanyard, protective pouch, etc.

The key characteristics of the Mark-MatriX™ taggant solutions have been the key drivers for the success of this unique security material

- Highly covert nature

- Inorganic material, inert to UV radiation, aging and harsh conditions.

- Forensic signature for project specific marking

- Wide range of detectors and sensor solutions

- Professional and efficient project management

Results

By working with NanoMatriX to improve their tax stamp solution, our customer’s tax collection system significantly improved. Our scope of delivered products and services comprised

- Project consulting

- Security feature selection and qualification

- Project implementation

- Detector sets with accessories

- User training and project specific documentation

- After sales support, including remote/ online training & technical support